Why put up with a boss when you can set up your own democratic workplace? Taking control of our own lives is the first step in the fight against the massive injustices and ecological devastation facing the world. Big companies and unaccountable governments may rule the planet right now, but it doesn't have to be this way. Workers' co-ops give us a chance to change a small but significant part of how things are. They're one way to gain control over how we work, and the impact our work has on others and our environment.

Workers' co-ops are part of the co-operative family – democratic, member owned enterprises set up for the benefit of the members and the wider community. In a workers' co-op only people who work for the organisation can be members: there are no bosses or shareholders, it's the people doing the work that have the say. All members have an equal say in running the business, including pay and work conditions.

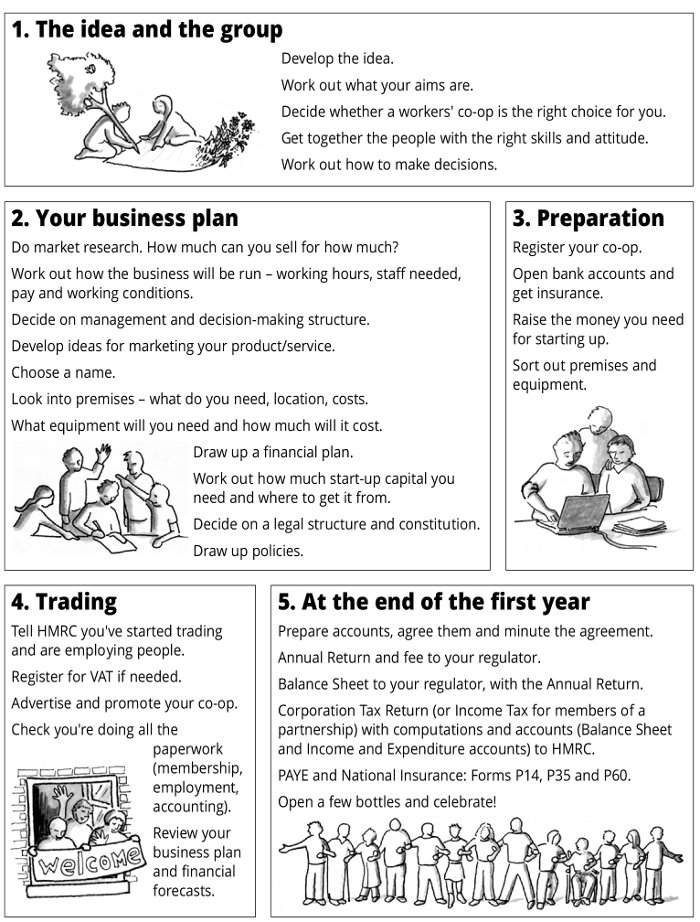

Starting a workers' co-op is exciting and rewarding but also full of challenges. It's like setting up any other business, except you're doing it collectively. Don't underestimate the huge amounts of time, commitment and learning that working collectively and setting up a business can take! The steps below will hopefully give you a guide to what work you need to do to get your co-op up and running.

The first thing to work on is the foundations that your co-op will be built on. Getting together a group of people who all want to work together for the same things, and who have the right skills and attitudes to get them done can be a real challenge. Develop and test your aims and business ideas together to check you are all pulling in the same direction. Work out whether a co-op is the right way of working together, and how you're going to make decisions – e.g. by consensus or voting. Address these questions early on and you'll have a great collective ready to face the exciting but uncertain year ahead.

It's time to put your business head on, and it's a good idea to seek advice on developing your business plan. Do market research: how much can you sell for how much? How will you market your products or service? Where will you make and sell it? What about working conditions: pay, hours, holidays, will you have collective management or a committee? Do the financial planning so you know how much start up capital you need, and when you can expect to break even.

You'll need to decide on your legal structure and draw up your governing document, choose a name and register. There are organisations that can help you do this, such as Radical Routes, Co-operatives UK and the Co-operative Enterprise Hub. They can also help you sort out your finance – ask them about loanstock, and where to get loans. Make sure you've got your start up money in your new bank account, that premises, equipment and insurance are ready. Tell HMRC when you've started trading and that you are employing people, and if relevant, register for VAT. Double check all the paperwork: membership, co-op policies, employment, accounting etc.

So now you officially exist, and can start doing what you set out to do, whether that's baking bread, mending bikes or installing IT systems. Get out there and spread the word! You can make a virtue of the fact you're a workers' co-op – and don't forget to buy services and supplies from other co-operatives where you can.

Once you've survived a year of trading, things will hopefully be settling down, and you'll have a good idea of whether things are going to work out well for your co-op. At the end of the first year you'll need to prepare your accounts and send them with your tax return to HMRC and send your annual return to your regulator (Companies House or the Financial Conduct Authority). Fill in all the employment related forms (PAYE and NI) and send them off to HMRC too. And last, but definitely not least – open a few bottles and celebrate!